History. Civil rights leader Martin Luther King Jr. said that The Civil Rights Act of 1964 was nothing less than a “second emancipation.” President John F. Kennedy, initially proposed the Act garnering strong opposition, but Kennedy’s successor, Lyndon B. Johnson signed it into law. The Act was championed for ending segregation in public places, and banning employment discrimination based on: race, color, religion, sex, and national origin. The Act was later supplemented to embrace pregnancy, age, and disability as additional protected classes.[1] The Act paved the way for two major follow up laws: The Voting Rights Act of 1965, which banned the use of obstacles (e.g. state and local poll taxes, literacy tests, refusal to tabulate or cast a vote, intimidation, threats, or coercion) preventing African Americans from exercising their right to vote as guaranteed by the U.S. Constitution’s 15th Amendment; and the Fair Housing Act of 1968 (“FHA”) which is the heart of this article.

Passing of the FHA, and MLK Jr.. On April 4, 1968, the day the Senate voted in favor of the FHA, Martin Luther King, Jr. was assassinated in Memphis, Tennessee. Amid a wave of emotions, including riots, burning, and looting in more than 100 cities around the country, President Lyndon B. Johnson pressured Congress to pass the new civil rights legislation before King’s funeral in Atlanta. On April 10, 1968, the House passed the FHA, and President Johnson signed it into law the following day.

Who does the FHA apply to? Property owners, property managers, developers, builders, architects, real estate agents, mortgage lenders, homeowner associations, insurance providers, and others who affect housing opportunities.

Prohibited Discriminatory Practices In Housing Sales and Rentals. It is discrimination to take any of the following actions because of race, color, religion, sex, familial status, or national origin and in some cases disability:

- Refuse to negotiate sales or rentals.

- Discourage sales or rentals.

- Discourage the purchase or rental of a dwelling.

- Misrepresent that a dwelling is unavailable for inspection, sale, or rental even though it is.

- Make unavailable or deny a dwelling.

- Refuse sales or rentals after making a bona fide offer.

- Different terms, conditions, or privileges of sales or rentals.

- Different services or facilities in connection sales or rentals.

- Make a statement of preference, limitation, or discrimination for or against a protected class. (for this reason, realtors are guided to use words that only describe the property, and avoid words as outlined more fully below).

- “Blockbusting” – For profit, persuade, or try to persuade, homeowners to sell their homes by suggesting that people of a particular protected characteristic are about to move into the neighborhood.

- “Steering” – steer a renter or buyer to a certain area.

- Deny access or membership to any MLS or real estate brokers’ organization.

- Different sales prices or rental charges.

- Different qualification criteria, applications, standards, or procedures, (e.g. income standards, application requirements, application fees, credit analyses, approval procedures or other requirements)

- Evict a tenant or a tenant’s guest.

- Sexual harassment (e.g. quid-pro-quo, or a hostile environment). Women, particularly those who are poor, and with limited housing options, often have little recourse but to tolerate the humiliation and degradation of sexual harassment or risk having their families and themselves removed from their homes. The Department of Justice’s enforcement program is aimed at landlords who create an untenable living environment by demanding sexual favors from tenants or by creating a sexually hostile environment for them.

- Fail or delay performance of maintenance or repairs.

- Assign person to a particular building, section, or neighborhood.

- Different terms or conditions of homeowner’s insurance.

- Retaliate against one who files, or assists in filing, a fair housing complaint or investigation.

- Fail to make reasonable accommodations and allow reasonable modifications necessary to allow persons with disabilities to enjoy their housing.

- Discriminate in appraising a dwelling

- In Lending: Charge different points, interest rates, or other costs.

- In Lending: Denying a mortgage, or charging higher interest rates for properties located in minority neighborhood

- In Lending: Fail to consider applicant’s disability-related income, such as SSI, or SSD.

- In Lending: Steering borrowers to loans with less favorable terms.

- In Lending: Refusing mortgages to women on maternity leave.

- In Lending: Providing a different customer service experience.

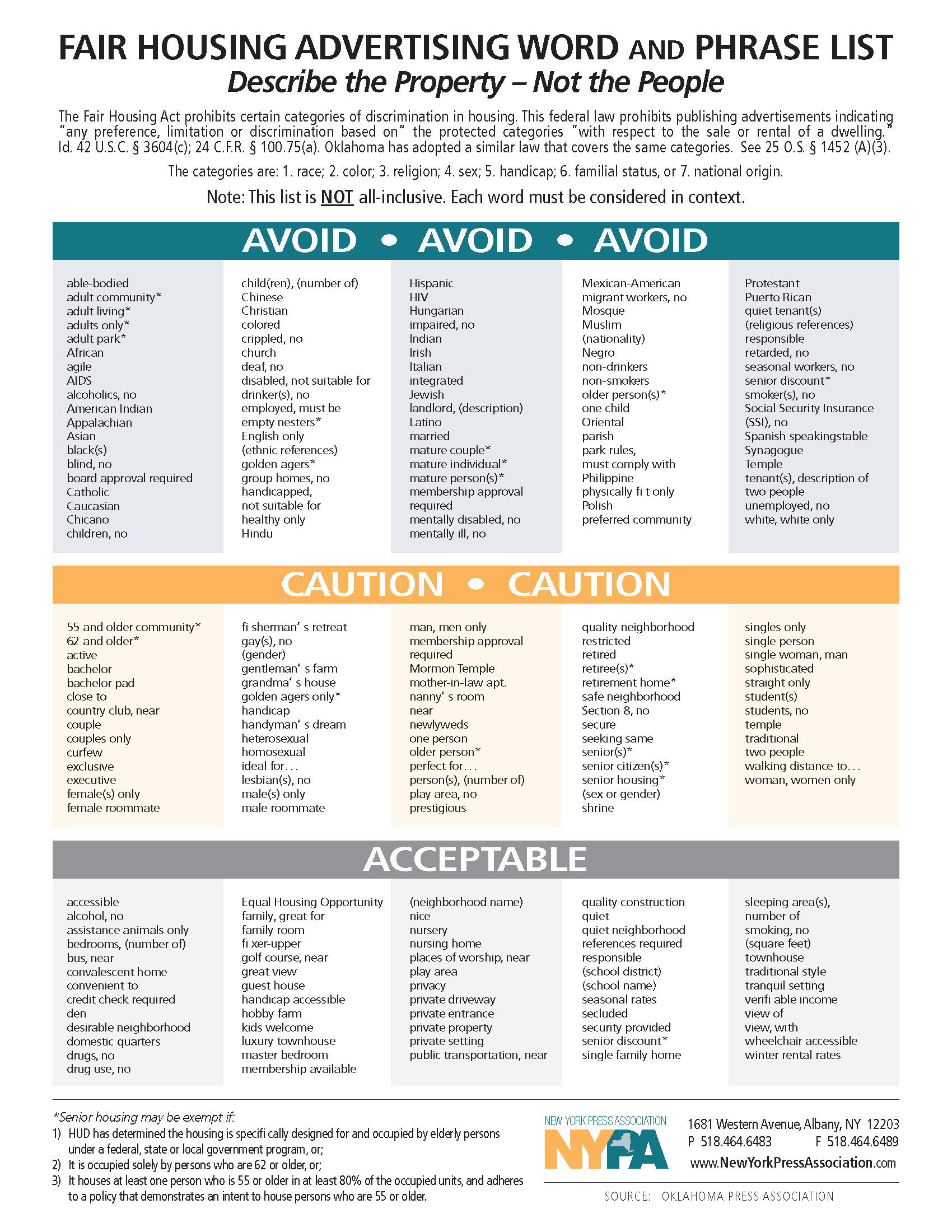

Words to avoid. All words must be considered in context, however a non-exhaustive list of words and phrases to generally “avoid,” “use caution,” and which are “acceptable” are found in this link.

“No criminal convictions.” Some statements may not seem discriminatory but in fact have a discriminatory effect, result in disparate treatment, and thus have a “Disparate Impact” on a protected class. Although criminal convictions are not by themselves a protected class, a 2016 HUD memo, titled Office of General Counsel Guidance on Application of Fair Housing Act Standards to the Use of Criminal Records by Providers of Housing and Real Estate-Related Transactions found that screening out all criminal convictions, regardless of underlying crime and when it occurred, could violate the FHA. The memo mentions that,

“Across the United States, African Americans and Hispanics are arrested, convicted, and incarcerated at rates disproportionate to their share of the general population. Consequently, criminal records-based barriers to housing are likely to have a disproportionate impact on minority home seekers.”

Drug or alcohol use. Under the Fair Housing Amendments Act, landlords cannot refuse to rent to someone on the basis of past drug addiction, or alcoholism, as this is considered a disability. However, current drug users, as well as individuals with convictions for drug sales or manufacturing, are not part of this protected category.

Exemptions from discrimination. The FHA generally exempts but subject to even more limited circumstances: (1) “The Mrs. Murphy exemption” i.e. an owner-occupied building with 4 units or less; (2) Sales or rentals by an owner of 3 or fewer single-family homes, provided no agent is used, no discriminatory advertisements are used, owns 3 or fewer single-family homes, is not in the business of selling or leasing dwellings, and has not sold a home in the previous 24 months; (3) housing operated by religious organizations for persons of the same religion; (4) Tenants constituting a direct threat to others health or safety, or whose tenancy would result in substantial physical damage to others’ property; (5) Housing for Older Persons (55+ years of age) may discriminate based on age; and (6) Private clubs not open to the public may limit occupancy to its members if the lodging is an incident to its primary purpose, and is owned or operated by them not for a commercial purpose.

Not so obvious examples of discrimination. A landlord locates families with children to a single portion of a complex, places an unreasonable restriction on the total number of persons who may reside in a dwelling, or limits access to recreational services provided to other tenants. Muslim woman wearing a jihab sees an advertisement and is told no units are available and asks to be put on a waiting list but never receives a call. Asian man interested in a neighborhood is asked by realtor if he will feel comfortable there, and another neighborhood with more “people like you” is suggested. Advertising ‘professionals only,’ may unfairly discriminate against people who can’t work due to disabilities.

Undercover Informants. Trained volunteers who, without any intent to rent or purchase, pose as prospects to gather information. These “Testers”, inform whether a housing provider is complying with fair housing laws or engaging in unlawful housing discrimination based on race, national origin, disability, or familial status. Most testing cases are based on allegations of agents misrepresenting the availability of rental units or offering different terms and conditions based on race.

HUD Enforcement. Housing discrimination complaints are investigated by The U.S. Department of Housing and Urban Development (HUD’s), Office of Fair Housing and Equal Opportunity (FHEO). Complaints may be filed within one year as an online complaint. FHEO intake specialist can be reached nationally at 1 (800) 669-9777 or 1 (800) 877-8339, in the regional office for Florida at (404) 331-5140 or (800) 440-8091, or directly at the Miami Field office at (305) 536-4456.

HUD’s Tools For Forcing Compliance. HUD may: conduct investigations, engage in “Conciliation” (i.e. mediate), request parties enter into a “Conciliation Agreement” (i.e. a written settlement or require the parties go to arbitration to award appropriate relief including monetary); make the conciliation agreement public, refer breaches of the conciliation agreement to the Attorney General’s Office for a civil lawsuit to be filed, at any time authorize the AG’s Office to file immediate injunctive relief pending final disposition of the complaint; and if the complaint relates to discriminatory housing practices may refer the matter to a State agency. Hearings may be conducted on an expedited basis before an administrative law judge, or by the AG’s office in United States District Court. Sanctions include: actual damages; injunctive relief; equitable relief; and civil fines up to $10,000 (1st time); $25,000 (>1 in 5yrs); or $50,000. If a real estate agent is found to have committed discriminatory housing practices HUD must refer the case over to the DBPR for disciplinary action.

Civil Lawsuits. Within two (2) years an aggrieved person (i.e. Someone who claims to have been injured, or will be injured, by a discriminatory housing practice) may sue, and the court may appoint an attorney upon application. The court may: award actual damages; award punitive damages; order temporary and permanent injunctions; issue restraining orders; compel affirmative action be taken; award attorney fees and costs; and award other relief as the court deems appropriate.

* Additionally, be aware that Florida’s Fair Housing Act (Fla. Stat. §§760.20-37), and any county or city rules that could add even more protected classes, such as source of income, age, or actual or perceived status as a victim of domestic violence, dating violence, or stalking.

DISCLAIMER: Topics discussed are general concepts, not intended to constitute legal advice, accuracy, nor completeness, and may not be relied upon as such; consult an attorney or accountant. The author Randy Gilbert, J.D. is neither an attorney nor an accountant. FTIC is a national award winning title insurance company known for its white glove customer service and “No Junk Fee Guarantee.” ®

[1] In 1988, Congress passed the Fair Housing Amendments Act, which expanded the law to prohibit discrimination in housing based on disability or on family status (pregnant women or the presence of children under 18).